Table of Contents

- WMT Stock Price and Chart — NYSE:WMT — TradingView — India

- Walmart, Inc. | $WMT Stock | Shares Boom On Strong Q2 Sales Growth ...

- 3 Reasons to Consider Buying Walmart Stock Right Now | InvestorPlace

- WMT Letter Logo Design on White Background. WMT Creative Circle Letter ...

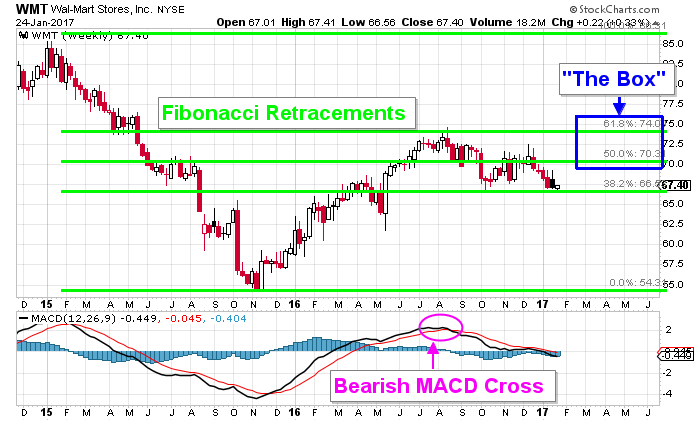

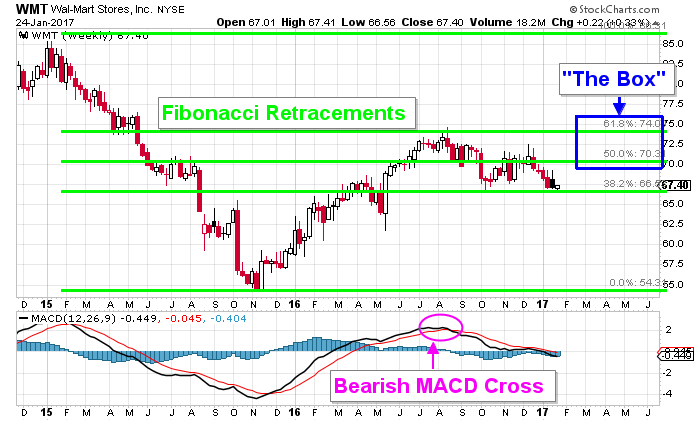

- Wal-Mart Stores Inc: WMT Stock (NYSE:WMT) Is Teetering on the Edge

- WMT -- Is Its Stock Price A Worthy Investment? Learn More.

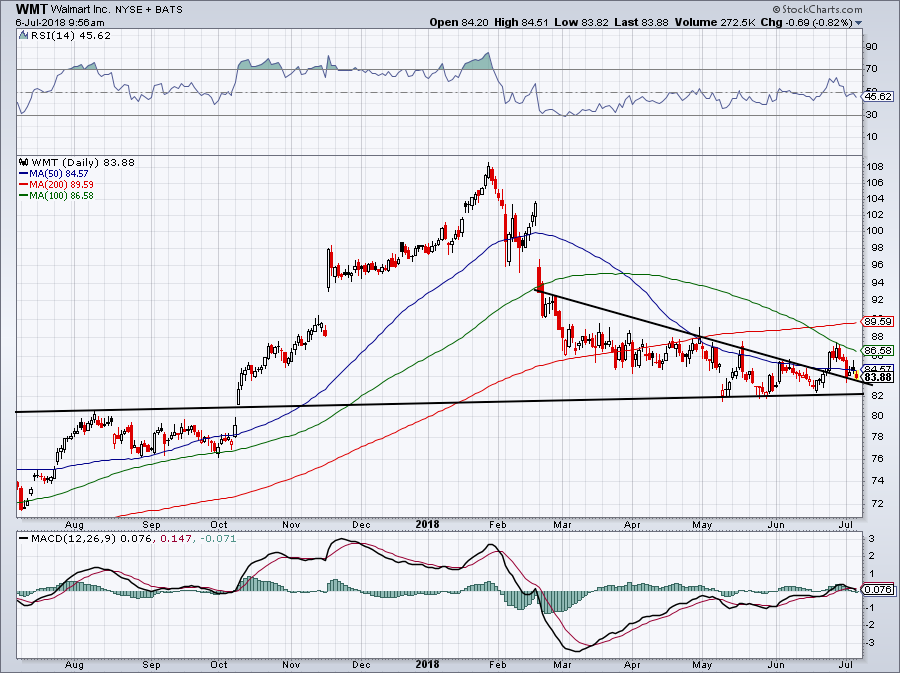

- WMT Stock Is a Buy Whenever It Drops to 5 | InvestorPlace

- WMT - Walmart Inc. Stock - Stock Price, Institutional Ownership ...

- Wal-Mart Stores Inc: WMT Stock (NYSE:WMT) Is Teetering on the Edge

- WMT Stock Is CRASHING & WARNING About The Economy - YouTube

Current Stock Price and Performance

Historical Overview

Key Factors Influencing Stock Price

Several factors contribute to the fluctuations in Walmart's stock price. Some of the key factors include: E-commerce growth: Walmart's efforts to expand its online presence and compete with Amazon have been a significant driver of its stock price. Store renovations and remodels: The company's investments in improving its store experience and services have contributed to increased customer satisfaction and loyalty. Global expansion: Walmart's expansion into new markets, particularly in emerging economies, has provided opportunities for growth and increased revenue. Competition and market trends: The retail industry is highly competitive, and Walmart's stock price can be influenced by changes in consumer behavior, economic conditions, and competitor activity.

Investment Outlook

Walmart's stock has been a stable and reliable choice for investors, offering a relatively low-risk investment opportunity. The company's dividend yield is around 2%, providing a steady income stream for investors. Additionally, Walmart's commitment to innovation and expansion has positioned the company for long-term growth. However, investors should be aware of the potential risks and challenges facing the company, including increased competition, changing consumer behavior, and global economic uncertainty. In conclusion, Walmart's stock price and overview offer a compelling investment opportunity for those looking for a stable and potentially growth-oriented stock. With its strong brand, extensive network, and commitment to innovation, Walmart is well-positioned to continue its success in the retail industry. As with any investment, it is essential to conduct thorough research and consider multiple factors before making a decision.Disclaimer: This article is for informational purposes only and should not be considered as investment advice. It is essential to consult with a financial advisor or conduct your own research before making any investment decisions.